City of Calgary, August 1, 2019 – For the fourth consecutive month, inventories in the market declined compared to last year. This is due to the combination of improving sales and a decline in new listings.

City of Calgary, August 1, 2019 – For the fourth consecutive month, inventories in the market declined compared to last year. This is due to the combination of improving sales and a decline in new listings. The market continues to favour the buyer, but a continuation in supply reduction compared to sales is needed to support more balanced conditions.“We are starting to see reductions in supply across the resale, rental and new-home markets,” said CREB® chief economist Ann-Marie Lurie.“This adjustment in supply to the lower levels of demand will support more balanced conditions. It is starting to support more stability in prices. If this continues, the housing market should be better positioned for recovery as we move into 2020.”

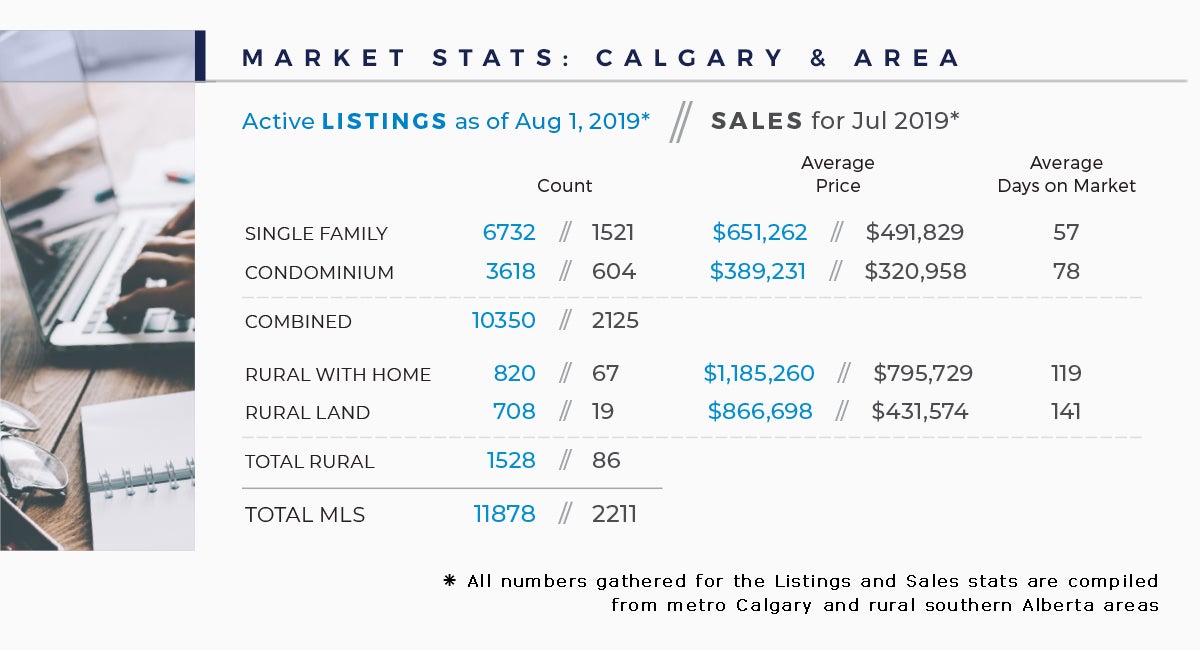

Year-to-date sales activity remains just below last year’s levels and well below longer-term averages. However, the reduction in inventory has caused the months of supply in July to ease to 4.5 months, a significant improvement from the 5.5 months recorded last year.

With less oversupply in the market, prices are showing some signs of stability on a monthly basis. This is causing the rate of price decline to ease on a year-over-year basis. Overall, year-to-date benchmark prices remain over four per cent below last year’s levels.HOUSING MARKET FACTSDetached

- Sales activity in July was slightly higher than last year’s levels, but it was not enough to offset earlier declines, as year-to-date sales remain just below last year’s levels. Despite overall declines, trends vary significantly by price range. Year-to-date sales for product priced below $500,000 have improved by 11 per cent compared to last year, while sales over $500,000 have declined by nearly 16 per cent.

- New listings continue to ease for detached product, reducing inventory across most price ranges. This is also starting to result in year-over-year declines in the months of supply for all prices ranges except homes over $1 million.

- Adjustments in sales and inventories also vary significantly by district. Year-to-date sales have declined across all districts except the North West and South districts. Easing inventories have not occurred across all districts, with year-over-year July inventory gains occurring in both the City Centre and West districts.

- Buyers’ market conditions persist, with detached benchmark prices at $488,400 in July. This is over three per cent lower than last year’s levels. Price declines range from a high of 5.7 per cent in the South district to a low of 1.4 per cent in the North East district.

- Despite improvement in July, year-to-date sales for apartment condominiums eased by over four per cent and remain well below longer-term averages.

- Available rental supply and ample selection in the new-home sector have impacted sales in the resale market. However, inventories continue to adjust, reducing the oversupply in this sector.

- With conditions favouring the buyer, prices continue to edge down. However, year-to-date benchmark price declines are not occurring across all districts, with modest gains occurring in the North East district.

- The attached sector is the only sector with recorded growth in year-to-date sales, up nearly four per cent. The affordable nature of this product, relative to detached, has likely supported some of these gains.

- The number of new listings continues to ease. This is causing inventory declines and reductions in oversupply. Like the other sectors, this segment continues to favour the buyer, preventing any significant changes in prices.

- Both row and semi-detached prices remain over three per cent lower than last year’s levels and well below historical highs. Attached price declines have been the highest in the City Centre district at over five per cent.

- For the fifth consecutive month, year-over-year sales improved in Airdrie. Year-to-date sales reached 757 units, over three per cent higher than last year. Improving sales combined with declines in new listings have resulted in less inventory in the market compared to last year. This market is moving toward balanced conditions.

- Oversupply is easing, but July benchmark prices remain over three per cent below last year’s levels. There are steeper price declines occurring in the higher density sectors of the market.

- Year-to-date residential sales in Cochrane totalled 376 units, slightly lower then last year’s levels. New listings have been in decline, resulting in the fourth consecutive month with a year-over-year decline in inventory.

- This has caused the amount of oversupply to ease, supporting more stability in pricing. As of July, the benchmark price in Cochrane is $408,300, over four per cent lower than last year’s levels.

- Total residential sales in Okotoks have totalled 321 units so far in 2019. This is similar to last year, but below long-term trends. New listings continue to trend down, supporting inventory declines and easing in the months of supply.

- As the amount of oversupply in the market eases, prices have been showing signs of improvement compared to the previous month. However, year-to-date benchmark prices remain over four per cent lower than last year’s levels.